Global corn production in 2023 and consumption have grown by almost 40% (39.0% and 37.1%, respectively) since 2011. China’s corn consumption in the same period added 68.2%, including production of +49.8% and imports of +339.8%.

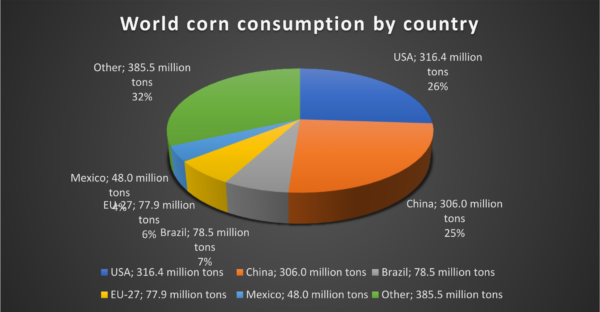

In 2023, China’s corn consumption in 2023 will be 306.0 million tonnes or 25.2% of total world consumption. In comparison, in the USA, the world’s leading corn producer, the figure is 26.1%. Four countries – the USA, China, Brazil and the EU countries – consume about 2/3 of the world’s maize.

China, with 23.0 million tonnes [12.1% of total imports], is the world’s largest importer of maize.

China also has the largest carryover maize reserves in the world, currently at 211.9 million tonnes or 66.3% of the world’s total (68.3% in 2022).

China thus has the greatest influence on the global maize market and its actions largely determine international trade and market prices.

The housing and infrastructure crisis in China has significantly reduced the consumption of corn starch – and therefore corn – and as a result, China has switched from importing corn to using carryover stocks, which has contributed significantly to the decline in grain prices.

Overcapacity in wet milling along with stagnation of the Chinese market has led to significant underutilisation of production assets, downtime and numerous bankruptcies. Using the “survive at all costs” model, Chinese producers are dumping. Buyers of corn products originating from China for political reasons restrict access to their markets, in particular to the US and European markets, and the insolvency of the Russian economy caused by sanctions in connection with the war in Ukraine increase downward pressure on buyer demand, forcing prices lower.

“The Chinese miracle”, which was achieved by the inflow of foreign investment in the construction of new plants and the supply of bioprocess technology, has turned political, putting pressure on China’s autocratic regime and, without economic and democratic reforms, has become the country’s problem.

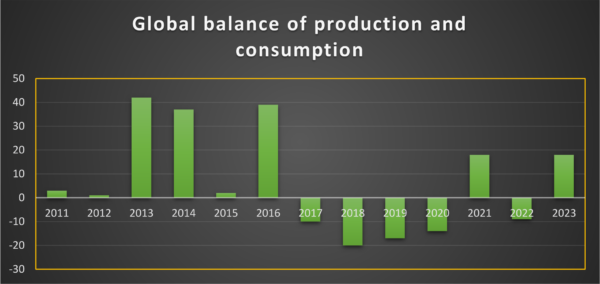

In addition, 2023 was characterised by global corn production exceeding consumption, which had an additional impact on the decline in global corn prices.

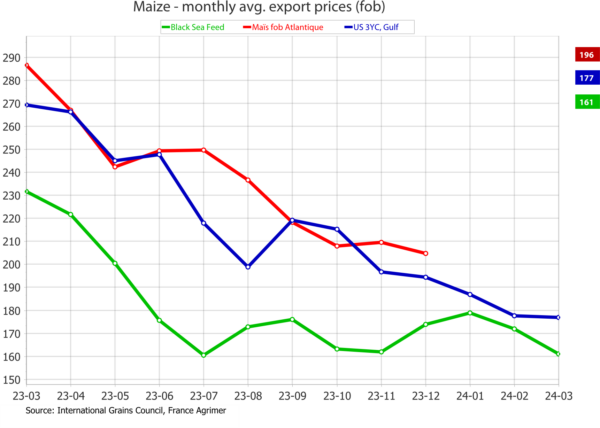

The world price for corn grain at the US exchange in Chicago continues to fall. Over the year the price of grain in the Gulf of Mexico ports fell from 270 $/mt to 176 $/mt. In Ukrainian ports, due to the war with Russia, freight surcharges are required as grain is exported from the war zone, so corn is trading lower: it was $230/mt in Mar-2023, now $160/mt in Mar-2024.

Nevertheless, there are the first signs that the grain market has reached the bottom and will change the direction of the vector towards higher prices. For example, this is such an indicator as the price of corn futures deliveries: at present spot prices for corn at the Chicago exchange in recalculation are 168 $/mt, with deliveries in May-2024 – 173 $/mt, in July 2024 – 176 $/mt, in September 2024 – 181 $/mt.

Another indicator of expected price increases could be the USDA March 2024 report, which estimates a decline in global corn production in 2023/2024 from 1232.6 MMT (Feb-2024 forecast) to 1232.6 MMT (Feb-2024 forecast). tonnes (forecast Feb-2024) to 1230.2 million tonnes (Mar-2024), along with an increase in consumption from 1210.8 million tonnes (Feb-2024) to 1212.2 million tonnes (Mar-2024), i.e. a utilisation of 3.8 million tonnes, which for an estimated overproduction of 18 million tonnes is an important support (more than 20%).

The third important indicator is the expectation from South America – mainly Argentina and partly Brazil – of information about El Niño, which will, in any case, adjust the figures for the first maize grain harvest in the South American market.